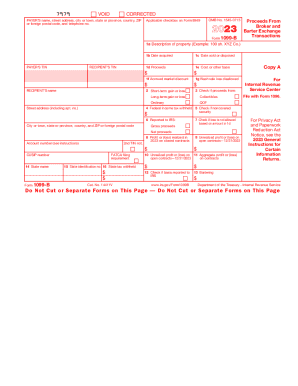

IRS 1099-B 2024-2025 free printable template

Show details

Attention: Copy A of this form is provided for informational purposes only. Copy A appears in red, similar to the official IRS form. The official printed version of Copy A of this IRS form is scannable,

pdfFiller is not affiliated with IRS

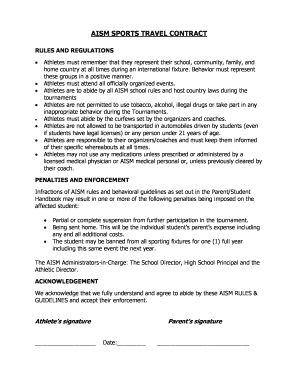

Understanding and Utilizing IRS Form 1099-B

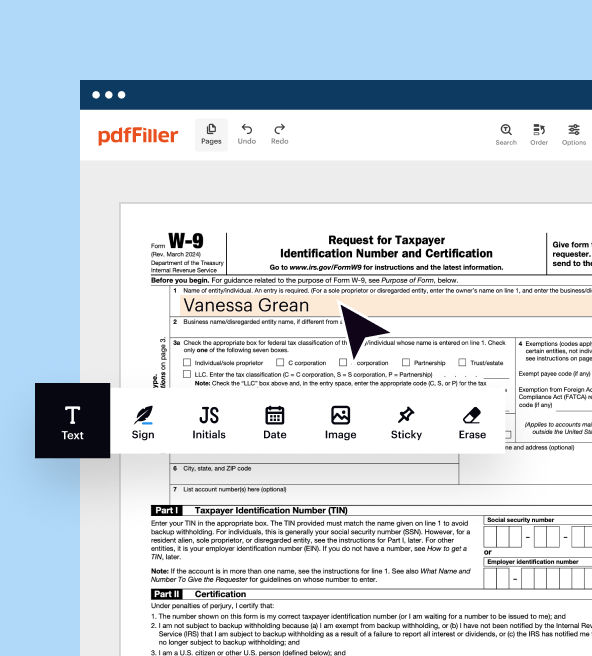

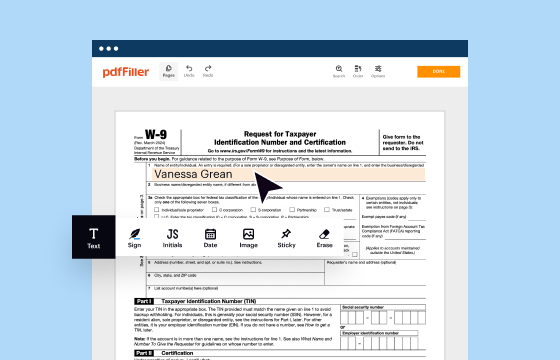

Detailed Steps for Editing IRS 1099-B

Guidelines for Completing the IRS Form 1099-B

Understanding and Utilizing IRS Form 1099-B

The IRS Form 1099-B is essential for reporting proceeds from broker and barter exchange transactions. Taxpayers and businesses use this form to ensure that their investment income is accurately reported to the IRS, and understanding how to complete it is vital for compliance and to avoid potential penalties.

Detailed Steps for Editing IRS 1099-B

To edit the IRS 1099-B form accurately, follow this step-by-step process:

01

Download the IRS 1099-B form from the official IRS website or obtain it from your broker.

02

Carefully review each section of the form, which includes details like your name, address, and taxpayer identification number (TIN).

03

Verify that your financial information, including sale proceeds and cost basis, is correctly entered. Adjust figures as needed.

04

Ensure that any transactions listed are complete and accurately reported, including transaction dates and relevant details.

05

Compile and verify all required attachment documents, such as a Schedule D, if applicable.

Guidelines for Completing the IRS Form 1099-B

Completing IRS Form 1099-B involves several key components:

01

Provide your name, business name (if applicable), address, and TIN at the top of the form.

02

For each transaction, list the description, date of sale, proceeds, and cost basis.

03

Indicate whether the transaction was long-term or short-term, as this affects capital gains tax calculation.

04

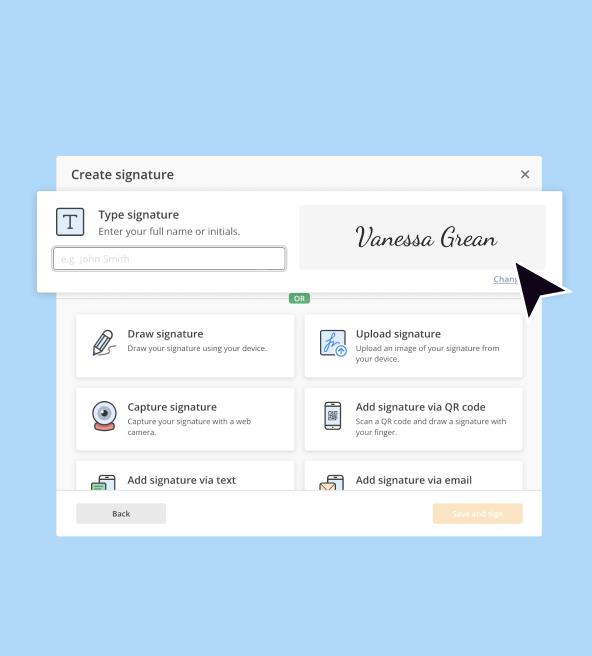

Sign and date the form before submission.

Show more

Show less

Recent Changes and Developments in IRS 1099-B

Recent Changes and Developments in IRS 1099-B

Stay updated on modifications to IRS Form 1099-B, including:

01

New electronic filing requirements that may affect brokers and financial institutions.

02

Increased transparency requirements related to cryptocurrency transactions.

Essential Insights Into IRS Form 1099-B

Defining IRS Form 1099-B

The Purpose of IRS Form 1099-B

Who Needs to Complete IRS Form 1099-B?

Exemption Criteria for IRS Form 1099-B

Key Components of IRS Form 1099-B

Filing Deadline for IRS Form 1099-B

Comparative Analysis: IRS Form 1099-B and Similar Forms

Transactions Covered by IRS Form 1099-B

Number of Copies Required for Submission

Penalties for Non-compliance with IRS Form 1099-B

Information Needed for Filing IRS Form 1099-B

Supporting Forms to Accompany IRS Form 1099-B

Submission Address for IRS Form 1099-B

Essential Insights Into IRS Form 1099-B

Defining IRS Form 1099-B

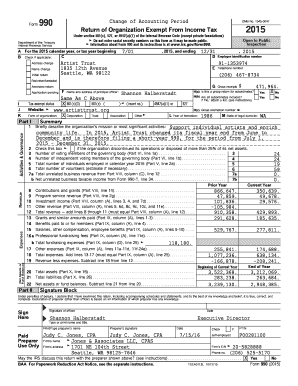

IRS Form 1099-B is a tax form that brokers and barter exchanges use to report proceeds from transactions involving stocks, bonds, commodities, and certain other securities. It's essential for accurately reporting capital gain and loss calculations on your tax returns.

The Purpose of IRS Form 1099-B

The primary goal of Form 1099-B is to report gains or losses from the sale of securities, ensuring taxpayers comply with federal tax laws. It helps the IRS track capital gains, ensuring proper tax liabilities are fulfilled.

Who Needs to Complete IRS Form 1099-B?

IRS Form 1099-B must be issued by brokers or barter exchanges that engage in transactions on behalf of clients. Additionally, individuals who profit from these transactions must report such income when filing their taxes.

Exemption Criteria for IRS Form 1099-B

Certain transactions might be exempt from 1099-B reporting, including:

01

Transactions below the minimum reporting threshold (e.g., less than $600 in proceeds).

02

Certain loans from financial institutions where no gain or loss was recognized.

03

Exempt platforms, such as specific pension plans or qualified retirement accounts.

Key Components of IRS Form 1099-B

The form consists of several key elements, including:

01

Broker or barter exchange's details (name, address, TIN).

02

Taxpayer's identification details.

03

Information on each transaction, such as sale date, proceeds, cost basis, and type of asset sold.

Filing Deadline for IRS Form 1099-B

The filing deadline for issuing IRS Form 1099-B is typically January 31st of the year following the reportable transaction. However, for electronic filings, the due date may differ slightly, so check IRS guidelines for the specific year.

Comparative Analysis: IRS Form 1099-B and Similar Forms

Similar to Form 1099-B, the IRS provides other forms like:

01

IRS Form 1099-S: Used for reporting proceeds from real estate transactions.

02

IRS Form 1099-DIV: For reporting dividends.

Understanding the differences can help ensure compliance with tax obligations concerning various types of income.

Transactions Covered by IRS Form 1099-B

IRS Form 1099-B specifically covers:

01

Securities sold through brokerages.

02

Barter transactions that occur through registered exchanges.

03

Sale of cryptocurrencies when executed through a trading platform.

Number of Copies Required for Submission

For reporting purposes, brokers typically need to submit three copies of IRS Form 1099-B:

01

One copy to the IRS.

02

One copy to the taxpayer.

03

One copy for state tax reporting, if applicable.

Penalties for Non-compliance with IRS Form 1099-B

Failure to file IRS Form 1099-B can result in substantial penalties, including:

01

A minimum penalty of $50 if filed late.

02

Higher penalties for intentional disregard of filing requirements, reaching up to $550 per form.

03

Potential legal consequences if not disclosed properly, including audits or increased scrutiny from the IRS.

Information Needed for Filing IRS Form 1099-B

To complete IRS Form 1099-B, you will need the following information:

01

Broker's or exchange name, address, and TIN.

02

Your own identifying information (name and address).

03

Transaction details including sale dates, proceeds, and cost basis.

Supporting Forms to Accompany IRS Form 1099-B

In certain situations, additional forms may be required alongside 1099-B, such as:

01

Schedule D: Used to report capital gains and losses.

02

Form 8949: Required for reporting sales and exchanges of capital assets.

Submission Address for IRS Form 1099-B

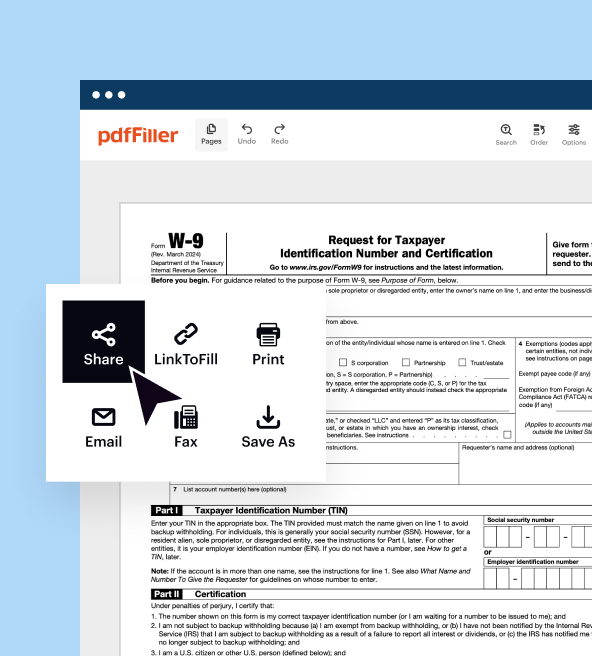

Submit IRS Form 1099-B to the address specified in the instructions provided with the form, typically based on your business location. E-filing options are also available for quicker processing.

Filing your IRS Form 1099-B accurately and on time is crucial for maintaining compliance and avoiding penalties. If you have questions or need assistance, consider contacting tax professionals for guidance. Start preparing your form today to ensure a smooth tax filing experience.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.